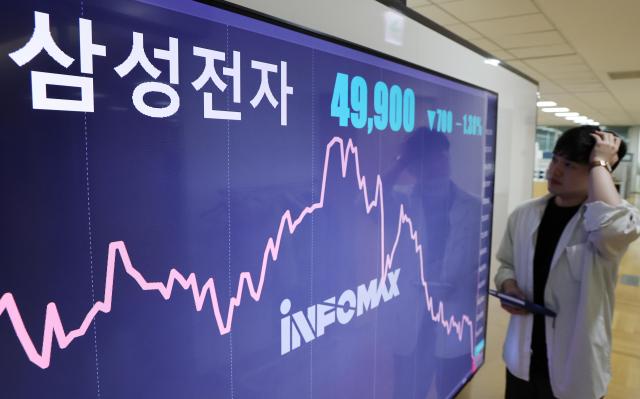

The stock closed at 49,900 won, down 1.38 percent from the previous day, marking its lowest level since June 15, 2020. The plunge pushed the tech giant's market value to 297.89 trillion won.

Foreign investors sold 477.2 billion won worth of shares, marking their 12th straight day of selling, with total disposals exceeding 3 trillion won since Oct. 30.

Mirae Asset Securities analyst Kim Young-gun lowered Samsung's target price from 110,000 won to 84,000 won, acknowledging "it's hard to deny that there was widespread optimistic outlook about the timing of high-bandwidth memory (HBM) sales materialization. We admit our prediction failure."

Investors are particularly concerned about potential tariffs under a second Trump presidency on Chinese imports, which could hurt Samsung given its high reliance on Chinese customers.

Trump has also repeatedly expressed skepticism about Biden's direct subsidies for chipmakers including Samsung, which planned factory investments based on these programs.

The semiconductor sector broadly declined, with SK Hynix falling 5.41 percent to 176,300 won ($135), amid concerns about potential increased Chinese trade restrictions under a Trump administration.

The Philadelphia Semiconductor Index dropped 2.00 percent on Monday, with major chip companies including AMD, Texas Instruments, Arm Holdings and Micron Technology falling more than 3 percent.

Copyright ⓒ Aju Press All rights reserved.

View more comments