The hydrogen vehicle market is facing a steep decline globally. According to SNE Research, a battery and electric vehicle analytics firm, global FCEV sales in the first quarter dropped 36.4 percent year-on-year to 2,382 units.

Hyundai, Korea's sole hydrogen vehicle producer, saw its sales of FCEVs plummet 66.2 percent to only 691 units during the same period, causing Korea’s global market share to drop to 26.5 percent from 51.1 percent a year earlier, ceding the top position to China, which controls 34.6 percent. Europe is rapidly catching up to Korea at 18.1 percent.

Hyundai’s FCEV exports dipped to zero in May and this year's total is expected to struggle to reach 100 units.

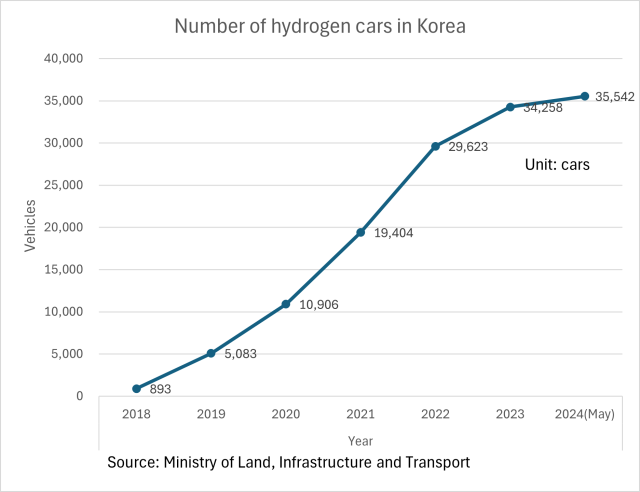

The number of registered hydrogen vehicles in the nation increased 15 percent year-on-year to 34,258 in 2023, while the number of registered electric vehicles rose by 39.5 percent to 543,900.

Experts attribute the slump to inadequate refueling infrastructure, high vehicle costs, a dearth of models and safety concerns.

"The limited supply of hydrogen gas, especially the shortage of hydrogen charging stations, is the primary problem,” said Yang Jae-wan, a researcher at the Korea Automotive Technology Institute.

There are only 324 hydrogen gas stations nationwide, compared to 350,204 electric vehicle charging stations, according to the Ministry of Environment. The government plans to install 85 more hydrogen gas stations by 2025.

Hyundai Motor is one of the hydrogen car pioneers, releasing the world's first mass-produced FCEV model, Tucson FCEV, in 2013, which was replaced by NEXO, a mass-market model, in 2018. The nation’s largest carmaker also rolled out ELEC CITY, a hydrogen fuel cell bus, in 2017.

"NEXO, a relatively old model from 2018, is currently the only locally produced hydrogen-fueled passenger car. Combined with high hydrogen prices and cases of defective hydrogen detected at some gas stations, electric vehicles are becoming major replacements for hydrogen-fueled vehicles,” Yang said.

Hydrogen fuel prices have risen 12 percent since late 2022, reaching an average of 9,864 won per kilogram. The NEXO runs about 96.2 kilometers per kilogram. That translates to around 102 won per kilometer for the NEXO, nearly twice as much as the fuel costs of electric vehicles.

Safety concerns have also cast a long shadow over the hydrogen vehicle industry. In 2023, 104 FCEVs, including buses, reportedly encountered faults linked to gas stations, primarily due to defective hydrogen gas exceeding carbon monoxide standards. More alarmingly, a series of high-profile accidents have eroded public confidence. In May 2019, an explosion at hydrogen gas tanks in Gangwon Province left two dead and six injured. Another incident in January 2022 saw a hydrogen gas station in Seoul experience a leak, leading to combustion and injuring two people.

"The current hydrogen gas stations are considered dangerous, and new liquid hydrogen fuel stations are much safer options. As they can be installed deep inside cities unlike hydrogen gas stations, which are usually on the outskirts of cities, liquid hydrogen fuel stations may lead to better accessibility for FCEV riders,” said Hwang Ji-hyun, a professor at the Korea Institute of Energy Technology.

The government's support for hydrogen mobility is also facing hurdles. Though the budget to promote the distribution of hydrogen passenger cars increased from 130.4 billion won in 2019 to 633.4 billion won in 2023, a growing portion of these funds remains unused. Last year, only 50.9 percent of the allocated budget was actually spent, down from 63.5 percent in 2022. Just 21.8 percent of this year's 571.4 billion won budget was utilized by April. Experts suggest that a part of the budget should be diverted to hydrogen commercial vehicles like trucks and buses.

Despite these challenges, Hyundai Motor is doubling down on the technology. On June 9, the company announced it took over the hydrogen fuel cell business from its affiliate Hyundai Mobis. "We will reinforce collaboration among our group companies to secure leadership in the hydrogen ecosystem," Hyundai Motor CEO Chang Jae-hoon said.

Copyright ⓒ Aju Press All rights reserved.

View more comments