[Yonhap News Photo]

SEOUL -- The operator of Toss, a leading fintech startup in South Korea, acquired a troubled mobility startup to disrupt a market dominated by the mobility service wing of the country's web service giant Kakao. The goal is to seek synergy between fintech and mobility services like Grab, a ride-hailing and logistics service in Singapore.

Viva Republica said it has signed a deal to acquire a controlling 60 percent stake in Value Creators & Company (VCNC), which runs Tada, from SoCar, a mobility service platform operator. Tada, a smartphone-based ride-hailing service, has rapidly grown to become South Korea's leading ride-offering service since it was launched using 11-seat multi-purpose vans in October 2018 in Seoul and its satellite cities.

However, Tada suspended its multi-purpose van service in 2020 after a transportation law was revised in favor of taxi drivers who have opposed the operation of vehicles driven without a taxi driver's license.

In the domestic mobility market, Kakao is a dominant player backed by some 10 million monthly active users as of August, followed by UT, a joint venture between Uber Technologies and a mobility business company spun off from South Korea's leading mobile carrier SK Telecom, with about 860,000 users.

South Korea's ride-sharing and car-hailing services have seen slow growth. However, big companies have revealed a solid strategy to foster an eco-friendly mobility business through preemptive investments in key materials and technologies in the electric vehicle market.

Viva will try to expand the scope of its financial business rather than competing with bigger rivals, create new values that combine mobility and fintech, and provide expanded services and benefits to some 20 million Toss customers. Viva Republica CEO Lee Seung-gun predicted synergy with financial services as half of the taxi market's sales come through call app services.

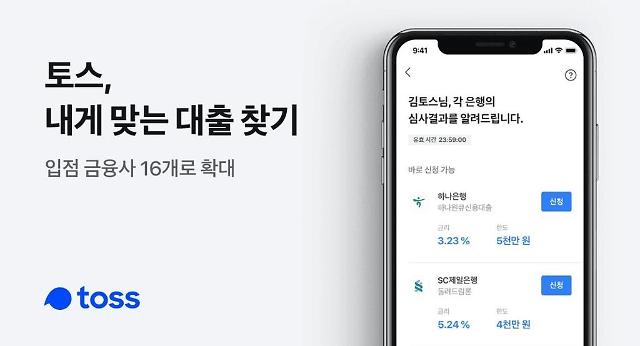

Viva has made its foray into South Korea's digital banking and peer-to-peer payment service, with its simple banking service gaining popularity. Users were allowed to access and manage credit, loans, insurance, investment and more from financial service providers. A consortium led by Toss has secured state approval to launch South Korea's third internet-only bank.

Copyright ⓒ Aju Press All rights reserved.

![[FOCUS] Pioneer in mobility service market grumbles at outdated regulatory barrier](https://image.ajunews.com/content/image/2019/10/29/20191029111258570278.jpg)

View more comments